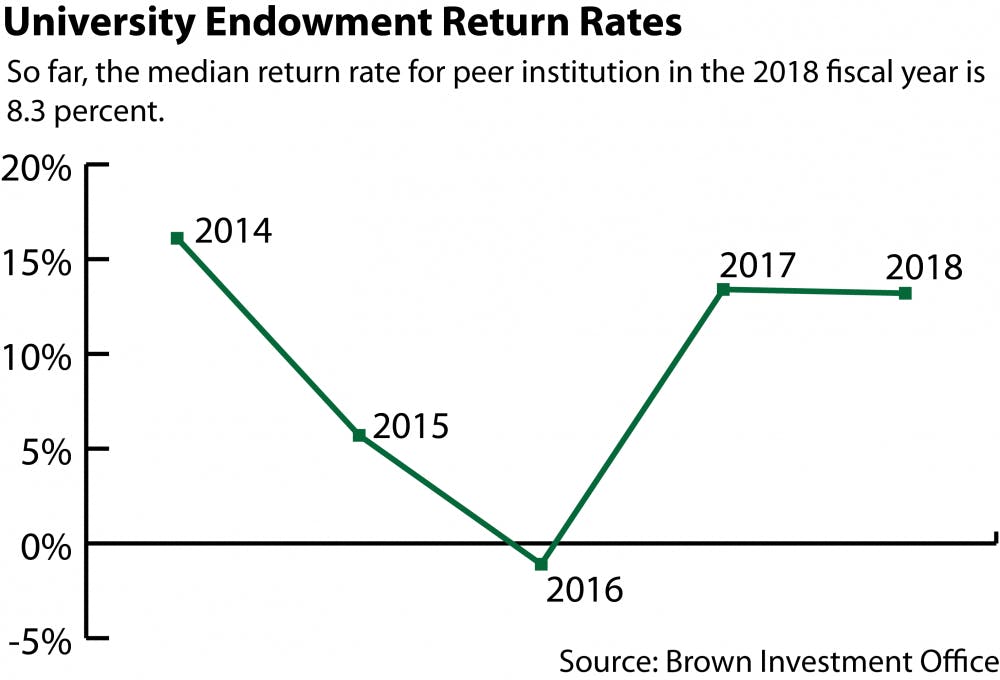

The University’s endowment increased to a record high of $3.8 billion over the 2018 fiscal year, according to a University press release. The endowment “returned 13.2 percent,” representing “$450 million in investment gains,” Managing Director of the Investment Office Joshua Kennedy wrote in an email to The Herald.

“The endowment’s mission is to financially support the many endeavors of the University’s faculty and students, shape the character of Brown as an institution and ensure its permanence,” according to documents obtained by The Herald. The endowment finances a variety of the University’s expenditures, including scholarships, professorships, instructional programs, libraries and athletics.

Compared to peer institutions, the endowment achieved a top quartile ranking for its returns over a one-, three- and five-year period, according to data from Cambridge Associates. So far, the peer median return in the 2018 fiscal year is 8.3 percent, as detailed in documents from the Investment Office.

The endowment also outperformed its aggregate benchmark of a 9.7 percent return. This benchmark is a “blended index comprised of the weighted average of the endowment’s asset class exposures,” Kennedy wrote. “Historically, the endowment has outperformed the aggregate benchmark, but this year we did so by a wider margin than usual.”

So far, only three other Ivy League universities have publicly released their endowment returns. The University’s endowment returns outperformed Harvard, Dartmouth and Penn, which returned 10 percent, 12.2 percent and 12.9 percent, respectively.

While the Investment Office is proud of its standing relative to peer institutions, “what really matters ... is meeting the spending needs of the University and keeping up with the cost increases of higher education,” Kennedy wrote. “In that regard the endowment’s performance has exceeded expectations in recent years.”

This year, the endowment “contributed $163 million to the University’s operating budget,” according to the University press release. This contribution “represents 15 percent of the annual operating budget, or $17,000 per student,” Kennedy wrote. The endowment also received $93 million in gifts, according to documents obtained by The Herald. These gifts made the 2018 fiscal year “an excellent year for giving to Brown,” he added.

The Investment Office has “a focus on first and foremost protecting the value of the endowment, and second, prudently growing its value and purchasing power over time,” Kennedy wrote. “The investment return that the endowment generated in Fiscal Year 2018 did not employ excessive risk.”

This year, 32 percent of the endowment was invested in absolute return strategies, 27 percent in public equity, 23 percent in private equity and 5 percent in real assets, according to documents from the Investment Office. Seventy-one percent of endowment assets were invested in North America and roughly 26 percent were invested in Europe and Asia.

“We have an excellent team that’s focused on generating strong risk-adjusted returns and is devoted to the educational mission of Brown. We receive strong guidance and support from our Investment Committee, and the University has tremendous momentum in terms of giving. All of this puts the endowment on solid footing,” Kennedy wrote.

The Investment Office recently changed its leadership structure in July, according to a University press release. Joseph Dowling became the University’s chief executive officer of the Investment Office, and Jane Dietze became the University’s vice president and chief investment officer. Joshua Kennedy took on Dietze’s former role of managing director. But “the change in leadership that took place earlier this year was really a formalization of roles that were already in place,” Kennedy explained.

ADVERTISEMENT