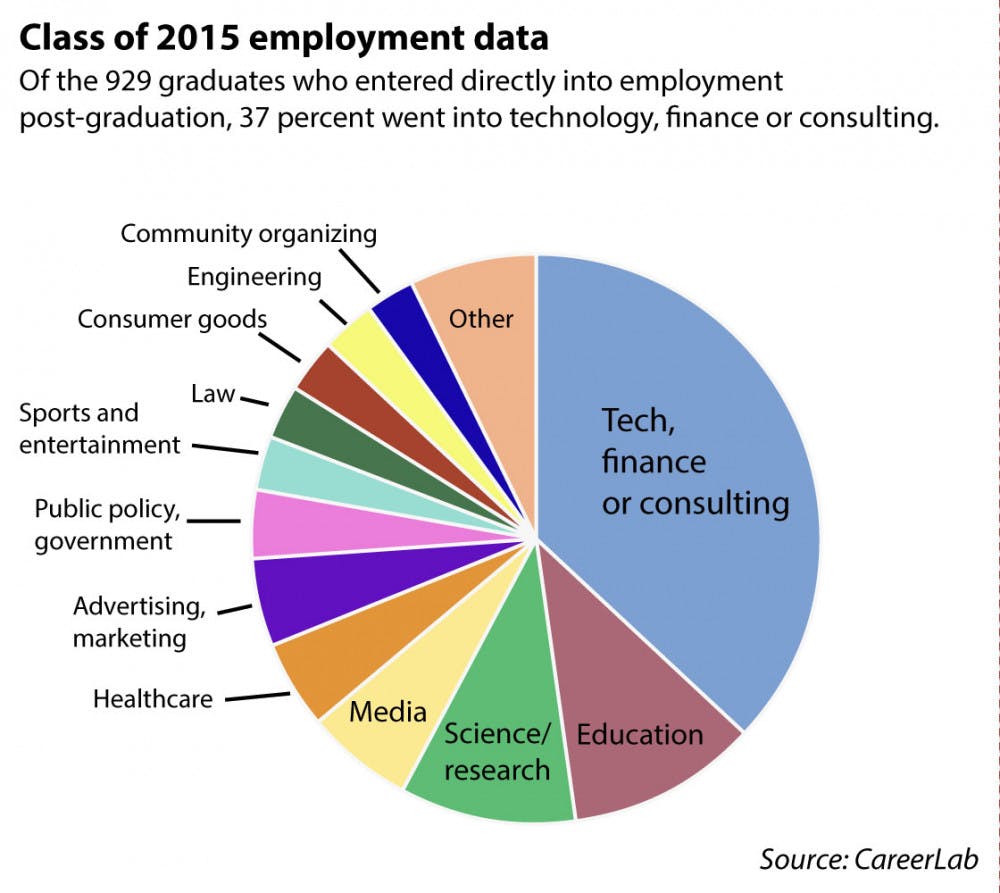

Of the alums who were immediately employed post-graduation in 2015, about 37 percent went into tech, finance or consulting, according to CareerLAB data. In 2011, data reported by The Herald show the number-one industry of employment was education, which has since been bumped down to number three, edged out by technology as well as finance, banking and real estate and followed closely by consulting, which lags education by just one percentage point.

To some extent, these industries create a “self-selection bias” among students, said Matt Donato, director of CareerLAB. Some students are drawn to corporate industries by factors such as high salaries and structured paths both to securing the job through recruitment and professional advancement later on.

Donato and his colleagues at CareerLAB encourage students to consider their job preferences holistically.

“What we want students to do is approach their decision from a much more informed, educated perspective,” he said. “If you can’t articulate why you want to do something, but you still pursue it, that’s where it gets a little bit concerning to me.”

A number of factors motivate more than a third of students to pursue employment in consulting, finance and technology. Interest in the work is widespread, but students also cite the financial perks and structured recruiting processes that the industries offer as incentives. More complicated is the link between Brown’s campus culture and the work environments these industries offer: While some consider the similarities abundant, other students and alums are more ambivalent about them. Some students looking to go corporate also face pushback from friends, who are skeptical about the ethics of lucrative jobs.

Recruitment and structure

Applying for jobs in finance, consulting and technology comes with a clarity of process that many students find appealing. “The pathway into this career path in finance and consulting is really, really clear. The recruiting process is incredibly structured,” Donato said.

Much like the pre-medical path offers students a definitive plan for the foreseeable future, a structured recruitment process gives students their next move without much consideration or planning. The structure of the recruitment process “kind of gave me something to look forward to,” said Kaitlyn Thein ’19, who is planning on a career in finance.

The dominant presence of big corporate industries recruiting at Brown can be attributed to large budgets and aggressive targets for entry-level positions, Donato said.

Goldman Sachs “maintain(s) a year-round presence on Brown’s campus, bringing back alumni and hosting events in both the fall and spring,” wrote Kristin Tougias, a Goldman Sachs recruiter, in an email to The Herald.

Google was the top employer of Brown students in the class of 2015 post-graduation, according to CareerLAB data. Among the top 15 biggest hirers in 2015 were other corporations such as DigitasLBi, Microsoft, Goldman Sachs, Barclays, McKinsey and Company, Morgan Stanley and J.P. Morgan.

Exposure to major companies boosts student interest in them, which may in turn reduce the likelihood that smaller companies see success in recruiting students.

When smaller firms come to campus, Donato said, students “don’t often look at them, because it’s not Goldman Sachs, or it’s not McKinsey.”

Having friends on campus or family members who work in finance, consulting and technology is another motivating factor.

Alexa Chukwumah ’19, who plans on going into sales and trading, said having parents who worked in finance provides her with much of the knowledge necessary to properly navigate that career path.

“When I got (to Brown), I realized a lot of people go into investment banking after they graduate, so then I started looking into that and then realized that’s maybe something I want to try out,” Thein said.

CareerLAB is working to diversify the organizations that recruit on campus.

Jaclyn Zhong ’17, who interned at AirBnB this summer and intends to return to the technology industry post-graduation, said she believes more students would work at smaller companies if they constituted a bigger recruiting presence on campus.

Some students and alums said they were not swayed by the structure of the recruiting process.

“It’s nice to know what steps to expect and what you have to do to keep moving through the process, but I wouldn’t say that’s the reason I want to do (finance),” said Josh Gelberger ’18.

Alums in these fields also did not seem to feel any push toward big corporations. “At a place like Brown, there’s not that external pressure; it’s all internal,” said Jack, who worked at a consulting firm and whose name has been changed due to his firm’s policy on speaking to the press.

“I think it was the right step for me, for my personal goals,” said Rayna Chandaria ’14, a McKinsey senior business analyst, speaking to the lack of external influence on her decision to work in consulting.

Of cash and callings

For some, entering big business has been met with stigmatizing reactions. Rose, whose name has been changed because her firm restricts employees from speaking to the press, was questioned by friends and family about her decision to enter finance, or what they called a “dog-eat-dog world.”

Another student going into finance was told she was “selling (herself) to Wall Street,” about which she said, “I kind of do feel that way.”

“I see it as something that I’m doing selfishly,” said that student, who requested anonymity for fear of professional repercussions. “I’m going to be doing (investment banking) maybe for two years and then hopefully go on to something I enjoy more.”

The stereotype that the finance industry is “money-obsessed” is valid, Chukwumah said. “Some people are definitely very much motivated by that.”

Chukwumah described her own situation differently. “I wouldn’t say that I’m money-obsessed, but I definitely think that I’m money-conscious,” she said. “When I’m choosing my career path, I want something that will provide me with a certain amount of security because I’m a woman especially.”

Opinions diverge on whether choosing a career path for the money is ethically reprehensible.

“I think it’s legitimate to make a choice that involves being able to raise a family and buy a house,” said Professor of International and Public Affairs and Political Science Ross Cheit, who teaches ethics and public policy, chairs the Rhode Island Ethics Commission and devotes part of his research to ethics regulation. “We think of education as something that allows people to move up in the world, and there are certainly students from Brown who that’s what those sorts of jobs allow them to do. And I can’t begrudge that for a minute.”

Large firms generally offer better financial security than smaller ones, making them an attractive option for those without a personal financial cushion.

“As a student at an Ivy League, if you don’t receive financial aid, you need some sort of way to pay for that education,” said Alexandra Coppa ’17. “So being a part of a corporate business is a good way to make money.”

“If you have no safety net, and you’re betting everything on a startup, it’s more risky inherently. Some people I don’t think can afford to bet all their hopes on a project,” said Curtis Stiles ’19, who is interested in design and technology.

Working for big-money corporations can also afford employees the opportunity to provide for various communities and organizations, including Brown. “People go (work for corporate industries) and then they help support this institution,” Cheit said. “They create scholarships for students to do great things.”

Most students and alums who end up in these fields do not seem to think of the ethics of the companies themselves as problematic or cause for hesitation.

“I think the stereotypical bankers that you see in movies are definitely not the people you usually see. That’s usually the exception, not the rule,” Rose said. “And I think that’s where a lot of these misconceptions come from.”

Campus culture to corporate culture

Careers in finance, technology and consulting have a lot to offer when it comes to resume building and professional development. “A lot of students want jobs in banking, consulting (and) tech because they are training grounds for other career paths down the road,” Donato said.

Consulting, a field that generally requires interfacing with companies in several industries, can set employees up to work in a variety of fields. “Regardless of what you do after, I think (consulting) provides a good platform for learning a lot of skills early on that you could translate to a number of different environments,” Jack said.

But the plan of spending a few years making extra money at a large corporation and then taking one’s skills elsewhere does not always translate into reality. “You get used to a certain lifestyle with consulting and with that environment, and you get in with a group of people that make it difficult to then leave,” Stiles said. “If you’re earning six figures and suddenly you’re bootstrapping at a Starbucks, it’s very different,” he added.

The variety of work experiences offered by fields such as consulting also appeals to Brown students for its similarity to the university’s culture of academic flexibility. “I think the culture is actually remarkably similar at McKinsey (to how) it is at Brown,” Chandaria said. “What I loved about Brown was that I got a diversity of experiences, and I wanted to do that in my first job out of college. And consulting is the epitome of doing that.”

Corporate tech culture tends to be laid back, especially in affording employees the flexibility to manage their own hours, Zhong said. She compared this freedom to the way college students are allowed to allocate their time at will.

Long hours at financial firms certainly differ from the schedules to which most college students are accustomed. But for some students, such as Chukwumah, a rigorous schedule “isn’t a deterrent,” she said. “Hopefully there are cool people that you’re working with so you don’t mind staying in and working that many hours. But I do also understand it’s a lot, being constantly focused on working for 12 to 15 hours every day.”