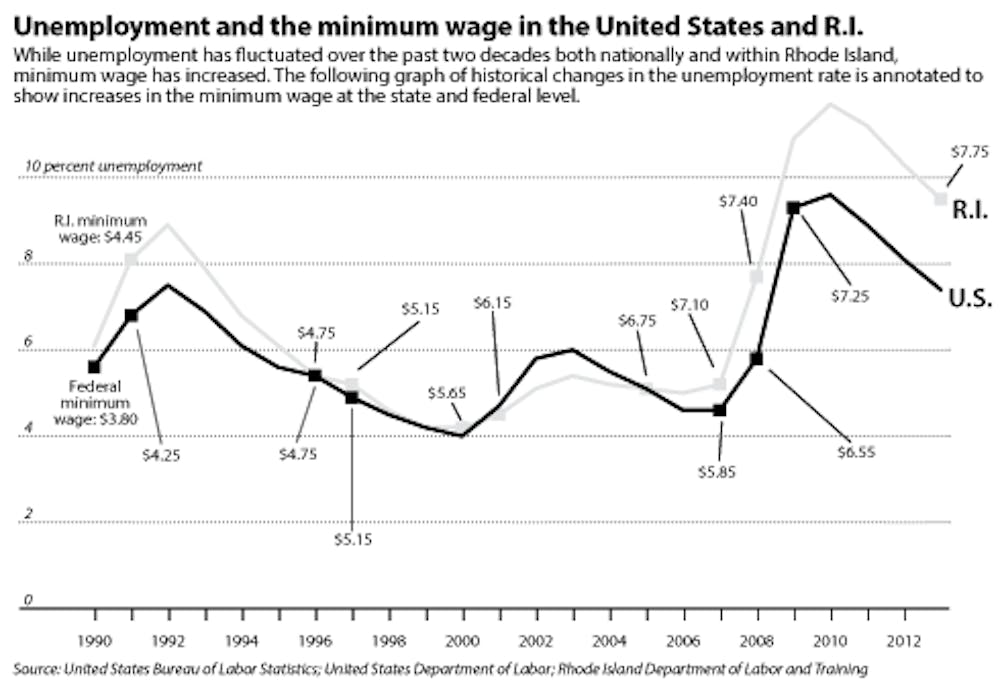

As the national unemployment rate inches back toward pre-crisis figures, Rhode Island’s rate has followed the general trend. But the state’s stubbornly high unemployment distinguishes it from national progress. As lawmakers attempt to identify the cause of the Ocean State’s struggles, a range of proposed solutions from public officials have emerged in recent months, including a minimum wage hike and unemployment insurance bill sponsored by Sen. Jack Reed, D-R.I.

When the national unemployment rate hit its peak of 10 percent in October 2009, it was still nearly two percentage points below Rhode Island’s peak of 11.9 percent, which occurred in January 2010, according to the Bureau of Labor and Statistics website.

While the national unemployment rate this January stood at only 6.6 percent, according to the U.S. Bureau of Labor Statistics, Rhode Island’s rate was 9.2 percent, according to the R.I. Department of Labor and Training.

Raising the federal minimum wage, one of President Obama’s recent initiatives, has garnered support from New England governors, including Lincoln Chafee ’75 P’14 P’17. The federal minimum wage is currently $7.25 per hour, and Rhode Island’s minimum wage is $8 per hour as of Jan. 1. Rhode Island was one of six states to increase its individual minimum wage since Obama first called for a federal increase in early 2013. And Chafee was one of several Northeastern governors to pledge Wednesday to raise their state’s wages to at least the $10.10 minimum proposed by Obama, in support of the campaign, the Associated Press reported.

The Minimum Wage Fairness Act, co-sponsored by Reed, would increase the federal minimum wage to $10.10 per hour over two years. Increasing the federal minimum would “put money back into the economy, increasing demand for goods and services and creating jobs,” Reed said in a statement sent to The Herald.

“Theoretically, we think that unemployment should go up when the minimum wage goes up,” said Nathaniel Baum-Snow, associate professor of economics and urban studies. But “the empirical evidence on this, I would say, is somewhat mixed. … It’s hard to determine whether there’s more unemployment when you raise the minimum wage,” he said.

Raising the minimum wage would also affect the labor market unevenly with a particularly negative effect on the lowest-wage earners, Baum-Snow said.“It makes it more costly for firms to hire workers, and (for) the people who would be willing to work for less than the minimum wage,” he said. “They don’t end up getting jobs.”

But Reed said a minimum wage hike is crucial to building a stronger middle class. “If Congress is serious about building ladders of opportunity and pathways to progress for the middle class, raising the minimum wage is one of the single most important investments we can make,” he said in the statement.

Though raising the minimum wage has commonly been proposed as a solution to income inequality issues, Baum-Snow said this would not necessarily ameliorate the effects for those with a high school education or less — a segment of the labor market that has experienced steady wage decreases since the 1980s.

“There’s a bigger underlying fundamental that there’s just less demand by firms to hire people without much education,” he said. “Because of that, they can offer less, and I think that sort of thing is only going to be exacerbated if we arbitrarily make them pay more to these people.”

Implementing the Minimum Wage Fairness Act would cut an estimated 500,000 jobs while increasing the earnings of about 16.5 million people, according to a Congressional Budget Office report.

“The proposal is more likely to serve as a rallying cry for Democrats in the approaching election than to be adopted by Congress in the foreseeable future,” the Providence Journal reported last week, adding that Democrats hope the bill “will appeal to economically squeezed voters in November’s midterm elections.”

Reed also filed the Emergency Unemployment Compensation Extension Act last Tuesday, which would retroactively extend unemployment insurance for “more than two million job-seeking Americans, including about 8,000 Rhode Islanders,” Reed said in the statement.

Emergency unemployment insurance expired Dec. 28. The legislation would also extend unemployment insurance by six months.

“The most recent Senate vote on a three-month unemployment insurance fix fell one Republican vote short of the necessary 60-vote threshold to overcome a filibuster,” Reed said in the statement.

“If Congress fails to act this year, … 21,700 Rhode Islanders will be cut off, and it will also mean 1,284 fewer jobs in Rhode Island,” he added.

ADVERTISEMENT