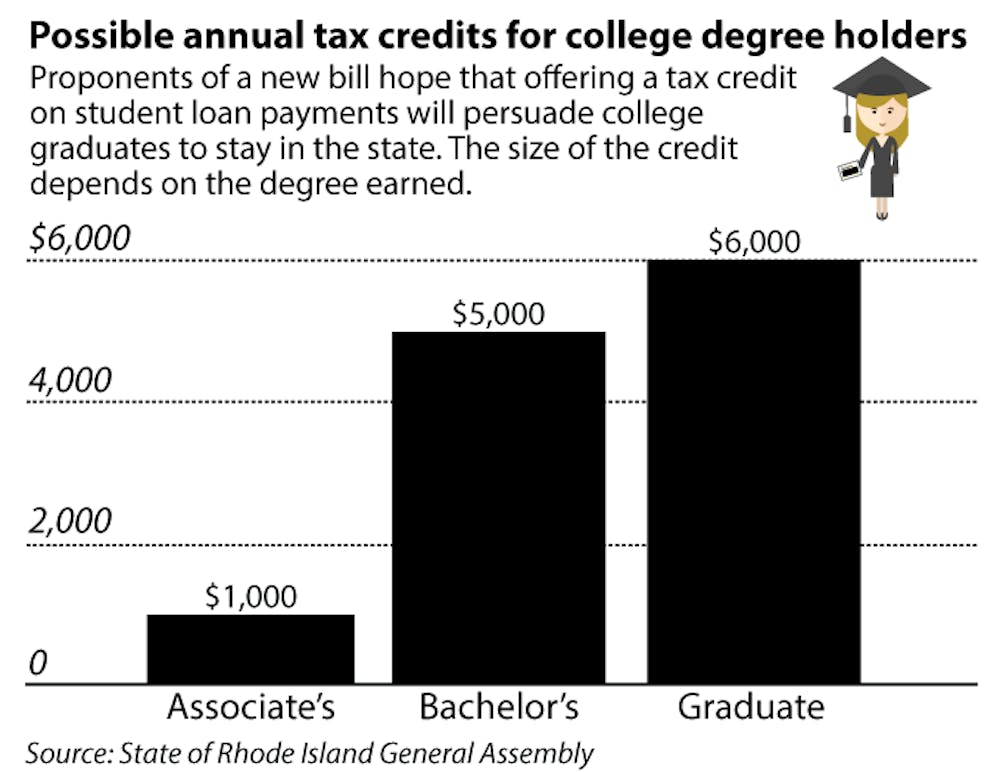

In an effort to improve the Ocean State’s retention of college graduates, local representatives recently introduced the “Stay Invested in R.I. Tax Credit” bill, which would offer a financial incentive to reside and work in Rhode Island, in the form of a tax credit on student loan payments.

College graduates with student loans who choose to live and work in Rhode Island will be eligible to receive a tax credit against their personal income tax for up to 10 years, according to the bill. The amount graduates can receive is dependent on the degree they earned — those with associate’s degrees can receive up to $1,000, those with bachelor’s degrees up to $5,000 and those with graduate degrees up to $6,000.

“The goal is to encourage, attract and retain talented college graduates to improve the workforce and thereby try to attract innovative businesses to come to Rhode Island,” said Rep. Christopher Blazejewski, D-Providence.

The co-sponsors of this piece of legislation are all 35 years old or younger, which Blazejewski said he believes has helped them recognize the need to support those paying off student loans.

“Some of us are recent college graduates who have heard about these issues from peers and parents of peers. There is a lot of support from young people but also from parents facing the prospect of having kids repaying student loans,” Blazejewski said.

Students said they have mixed feelings about what sort of impact the bill will have in retaining recent graduates.

“I don’t think that students will stay in Rhode Island simply because of an extra few bucks in their pocket,” said Bradly VanDerStad, a senior at Johnson and Wales University. Promoting concrete ties between local businesses and the state’s universities could prove more effective in keeping graduates in Rhode Island, he added. “It would foster more of an attraction to the state by offering state-sponsored internships while the students are in university.”

Other students said they believe the tax credit is a good first step to improving Rhode Island’s economy and stopping the “brain drain.”

“It can only help. There’s lots to build on. There’s a great culture for innovation and room to grow here,” said Kevin John Garcia ’18. “It’s a two-way street. If the state delivers on getting businesses actually in the state, that’ll be the best way to tackle the problem. We need somewhere for our students to land.”

Finance committees have yet to hear and ascertain whether the state will make the monetary commitment this bill would entail, but Blazejewski said he is hopeful that the bill will be passed by May or June of this year.

“This is exactly the kind of economic tool that the state of Rhode Island needs,” Blazejewski said, adding that growing the state’s workforce of college graduates could also help attract innovative companies.