The Corporation authorized a 4.1 percent tuition hike for the 2016-2017 academic year last month. This increase is consistent with past years — after a 4.4 percent increase for the current academic year and a 3.8 percent increase for the previous year — as the cost of higher education continues to rise across the country.

But the issue may be particularly acute in Rhode Island. In 2014, graduates of colleges in the Ocean State had the fourth highest average debt in the nation, according to a report published by the Institute for College Access and Success.

The cost falls on young adults at the least opportune time in their financial lives: just as they attempt to forge careers and build a solid credit history. Despite financial aid packages and the promised employability of college graduates, today’s American college students and graduates have a collective $1.3 trillion debt to pay, according to a report the Federal Reserve published earlier this year.

With this problem in mind, U.S. Sen. Sheldon Whitehouse, D-RI, sponsored the Reducing Education Debt Act with a group of other Democratic senators mid-January to alter the structure of federal student loans. Meanwhile, officials from colleges in Rhode Island are working to improve financial aid and literacy among their students.

Reducing Education Debt Act

The Reducing Education Debt Act primarily seeks to “strip out the money-making role of government in student loans,” Whitehouse said.

The 2010 Student Aid and Fiscal Responsibility Act partially reformed the student loan system, said Richard Davidson, press secretary for Whitehouse. The act eliminated the costly role of “middlemen” banks in federal student loans, according to a 2010 Daily Finance article.

But the government still makes revenue off the federal student loans it issues, Whitehouse said.

“The government treats (student loans) like any other lender would treat a loan,” Davidson said. Interest on federal student loans can become substantial as it accumulates over years, he added.

The RED Act contains three main provisions: First, it seeks to make student loans refinanceable. Unlike credit card or auto debt, student loans — both federal and private — are currently ineligible for refinancing. “There’s a fundamental injustice about (this policy),” Whitehouse said. Not only are the terms of federal and private student loans unusually stringent, but they also target a population that may not have the financial literacy to understand the debt they are taking on, he said.

Student loans have been written out of bankruptcy codes, which is how college debt becomes inescapable for so many individuals, Davidson said, adding, “I think everybody agrees that (the current policy) is a bad idea.”

The RED Act would allow students to refinance their federal or private loans as new federal loans at the interest rates “offered to new federal borrowers in the 2013-2014 school years,” according to the act.

The act states that 81 percent of borrowers who have a debt greater than $40,000 have taken out private student loans that carry interest rates of 8 percent or more. Allowing students to refinance their debt into federal loans would “take a substantial burden off of students’ shoulders,” Davidson said.

Second, RED seeks to “make two years of community college as universal as high school” by making it tuition-free, according to the act. The act proposes a “federal match of $3 for every $1 invested by the state to waive community college tuition.” The act also calls for similar tuition subsidies to be extended to “minority-serving institutions” and hopes to create “a new partnership between federal government and states and Indian tribes” to make community college more accessible to indigenous populations.

Finally, RED seeks to permanently index Pell grants to the consumer price index, ensuring that they keep pace with inflation. Under the current policy, Pell grants are pegged to inflation, but that peg must be renewed in 2017, leaving future low-income college students vulnerable to the unpredictability of federal politics, Davidson said.

The act states that “61 percent of students who receive Pell grants have to take out loans compared to 29 percent who do not receive the grants.” The act seeks to preserve the “purchasing power” of a Pell grant and in doing so prevent students from taking on additional loans to cover the inflationary gap that would arise if student loans were to lose pace with the CPI.

Whitehouse acknowledged that it could be an uphill battle to pass the RED Act into law. Though it is in the long-term national interest to make higher education more accessible, short-term budgetary concerns could be a source of conflict within Congress, he added.

The act is set to be presented for congressional vote later this month. Even if the act does not get passed, it will hold symbolic value, as it will force members of Congress to take a position on rising college costs, Whitehouse said.

College affordability in Rhode Island

Donald Farish, president of Roger Williams University, noted that it is also the responsibility of universities to make higher education more affordable.

“When I came here … still on the heels of the great recession of 2008, family incomes had been falling,” Farish said, adding that raising tuition in a recession and post-recession economy did not seem like “the right thing to do.”

Roger Williams guarantees that each entering class will be charged the same tuition fee over four years — a policy he said can also be implemented by many other colleges.

But Farish explained that when universities raise tuition, much of colleges’ and universities’ extra income goes back to students through financial aid packages.

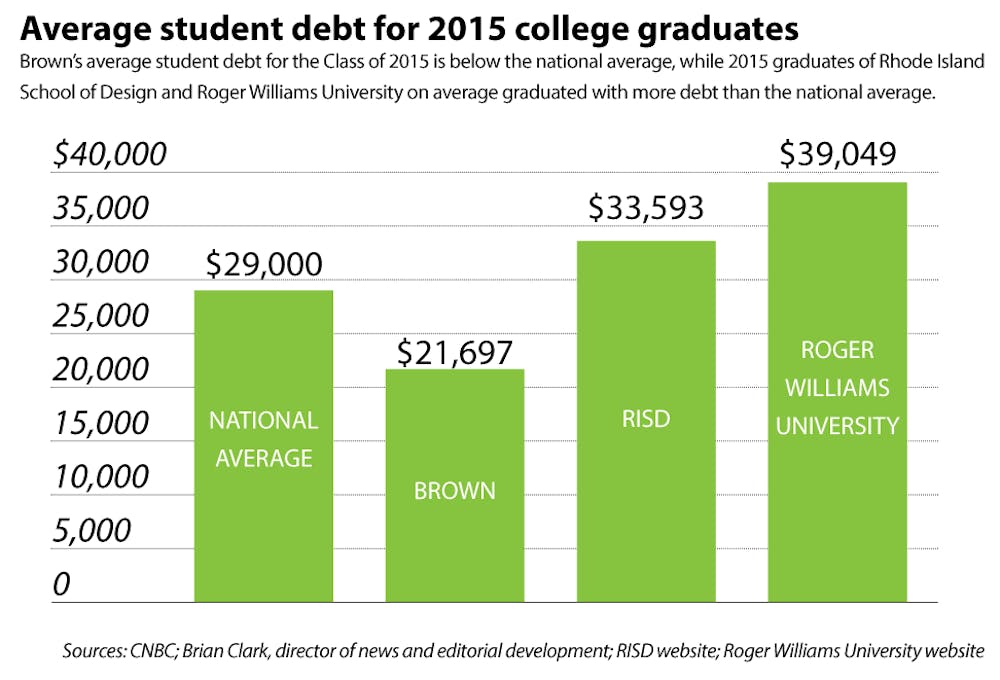

According to its website, the average student debt at Roger Williams is $39,049 compared to the 2015 national average of $29,000.

In part, the circle of universities that Roger Williams competes with experiences a “market response” when tuition costs change, Farish said, adding that students may not choose to attend Roger Williams if tuition were too high. In a way, certain colleges have to compete with their peers through their price tags, but the same cannot necessarily be said for “name brand” schools like Harvard or Yale, he added.

Brown also offers a loan education program — “Get Your Bearings” — aimed at bolstering student financial literacy and encouraging smart financial planning, wrote Brian Clark, director of news and editorial development, in an email to The Herald. The University also offers counseling services to students planning on taking out loans, he wrote, adding that the goal of these services is to help students only borrow as much as they need “rather than automatically borrowing the maximum amount for which they are eligible.”

Since 2009, the University has provided loan-free financial aid packages to any student with a family income below $100,000, he wrote. Students with family incomes above that amount may be offered financial aid packages including loans, but the loan amounts are guaranteed to “remain consistent throughout four years at Brown,” he added.

Over the past five years, an average of 35 percent of Brown’s graduating seniors have taken out loans while enrolled at the University. The class of 2015’s average indebtedness was $21,697 — a decline from the $23,967 average for the class of 2014, he wrote. The average national student debt in 2014 was $33,000, Clark added.

But Brown students still have the largest debt in the Ivy League, The Herald previously reported.

Meanwhile, Rhode Island School of Design has expanded financial aid by 45 percent in the past five years and the rate of tuition increase will remain flat for the upcoming school year, wrote Jaime Marland, director of public relations at RISD, in an email to The Herald. The school also takes specific measures to increase financial literacy among students taking on loans, Marland wrote.

The average student debt for the RISD class of 2015 was $33,593, according to the RISD website.

The effectiveness of RISD’s financial education initiatives is apparent “through our low loan default and high retention rates compared with other schools,” Marland wrote.

Correction: A previous version of this article stated that Jaime Marland, director of public relations at RISD, wrote in an email to The Herald that the Rhode Island School of Design tuition will remain flat in the upcoming school year. In fact, Marland wrote that the rate of increase will remain flat for the upcoming school year. The Herald regrets the error.